Digital Identity Beyond Aadhaar: Blockchain-Based Identity in India

How blockchain can create secure, portable, and privacy-friendly identity systems for citizens and businesses

1. Introduction: The Next Leap in India’s Digital Identity Journey

India’s digital identity story is among the most ambitious in the world. With over 1.39 billion enrolments, Aadhaar has become the backbone of countless public-service systems—ranging from direct benefit transfers, e-KYC, financial inclusion, and taxation to digital public goods like UPI, DigiLocker, and CoWIN. No other developing country has managed identity at such scale, speed, and accuracy.

Yet, even as Aadhaar continues to play an essential role, the landscape of digital identity is rapidly evolving. Global conversations are shifting to concepts such as:

- Self-Sovereign Identity (SSI)

- Decentralised Digital Identity (DID)

- Verifiable Credentials (VC)

- Privacy-by-Design identity frameworks

- Zero-knowledge proofs (ZKPs)

- Selective disclosure of personal data

At the core of these ideas lies one transformative technology: blockchain.

A blockchain-enabled identity system does not replace Aadhaar. Rather, it complements, strengthens, and expands the scope of India’s digital identity ecosystem—making it more secure, interoperable, portable, and privacy-preserving for citizens and businesses.

This article explores how India can move towards a future-ready digital identity framework, how blockchain transforms identity management, what global models can be emulated, what challenges India will face, and how this transformation could unlock new socio-economic value over the next decade.

2. Why India Needs Digital Identity Beyond Aadhaar

Aadhaar successfully solved the first-generation identity challenge:

How to uniquely identify 1.3+ billion residents using biometrics?

However, the future requires solving deeper challenges:

2.1. Challenge of Centralisation

Aadhaar is a centralised identity repository, which—despite strong security controls—faces:

- A single point of failure

- Centralised data storage risks

- Risks of identity misuse at the point of authentication

- Limited user control over attributes

Blockchain-based identity models distribute trust, reducing dependency on any one authority.

2.2. Privacy and Selective Disclosure

Aadhaar in its basic form provides a Yes/No authentication.

But future identity interactions will require:

- Revealing only necessary data (e.g., proving age without sharing date of birth)

- Anonymous verification

- Zero-knowledge interactions

- Pseudonymous identifiers for different contexts

India needs a privacy-centred identity architecture that gives citizens greater control.

2.3. Interoperability Across Systems

As India’s digital public infrastructure (DPI) expands, identity must become:

- Portable across systems and jurisdictions

- Machine-verifiable

- Trustworthy even outside Aadhaar’s ecosystem

- Usable for global mobility (travel, work, study, trade)

Blockchain-based credentials enable trust verification without dependency on Aadhaar servers.

2.4. Identity for Machines, Devices, and Enterprises

Aadhaar is for humans.

But India’s digital economy increasingly requires identity systems for:

- IoT devices

- Drones

- EV chargers

- Autonomous vehicles

- Businesses and MSMEs

- Supply-chain assets

- Smart-city infrastructure

Blockchain enables verifiable identity for machines, a crucial foundation for Industry 4.0.

2.5. Reducing Authentication Costs and Fraud

Identity fraud—KYC fraud, SIM swap fraud, fake certificates, forged documents—costs India billions.

Blockchain can dramatically reduce:

- Duplicate identities

- Fake document circulation

- KYC overheads (banks spend ₹25–50 billion/year on it)

- Onboarding friction in BFSI, telecom, healthcare

Thus, the next stage of India’s digital identity must go beyond centralisation and beyond biometrics, towards a distributed trust model.

3. Understanding Blockchain-Based Digital Identity

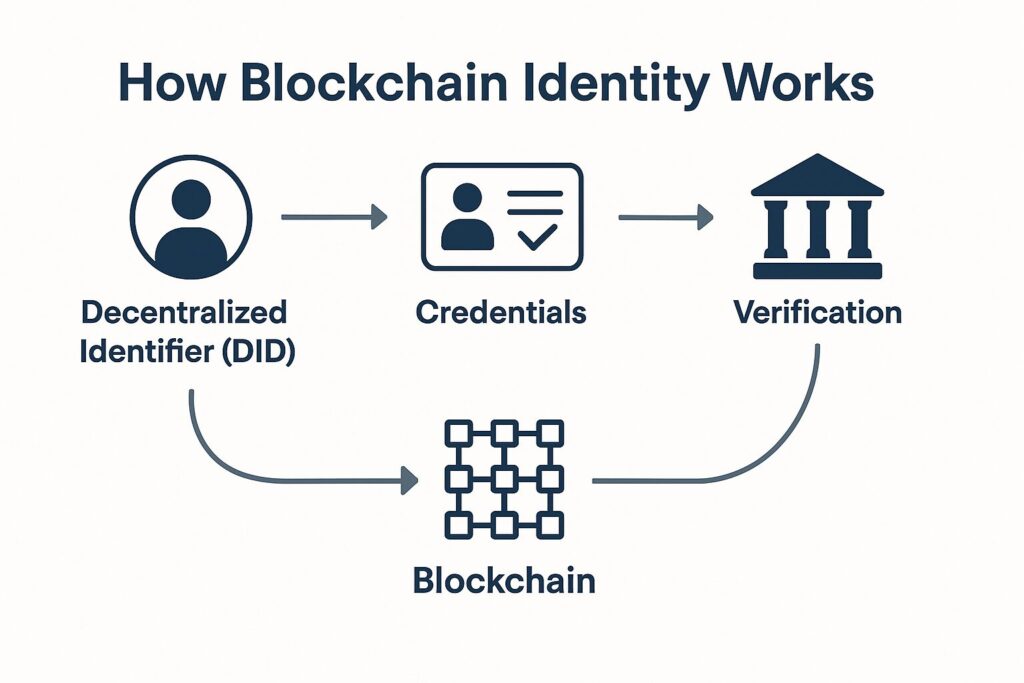

Blockchain-driven identity builds on three fundamental components:

3.1. Decentralised Identifiers (DIDs)

A DID is a unique, blockchain-anchored identifier controlled by the individual or organisation.

It replaces traditional identifiers like:

- Email IDs

- Mobile numbers

- Aadhaar numbers

- Passport numbers

A person can have multiple DIDs for different uses—some public, some private.

3.2. Verifiable Credentials (VCs)

These are digitally signed certificates issued by trusted authorities.

Examples:

- Driving licence

- Passport details

- School degree

- Vaccination certificate

- MSME registration

- GST details

The issuer signs them cryptographically; verification is instant, trustless, and tamper-evident.

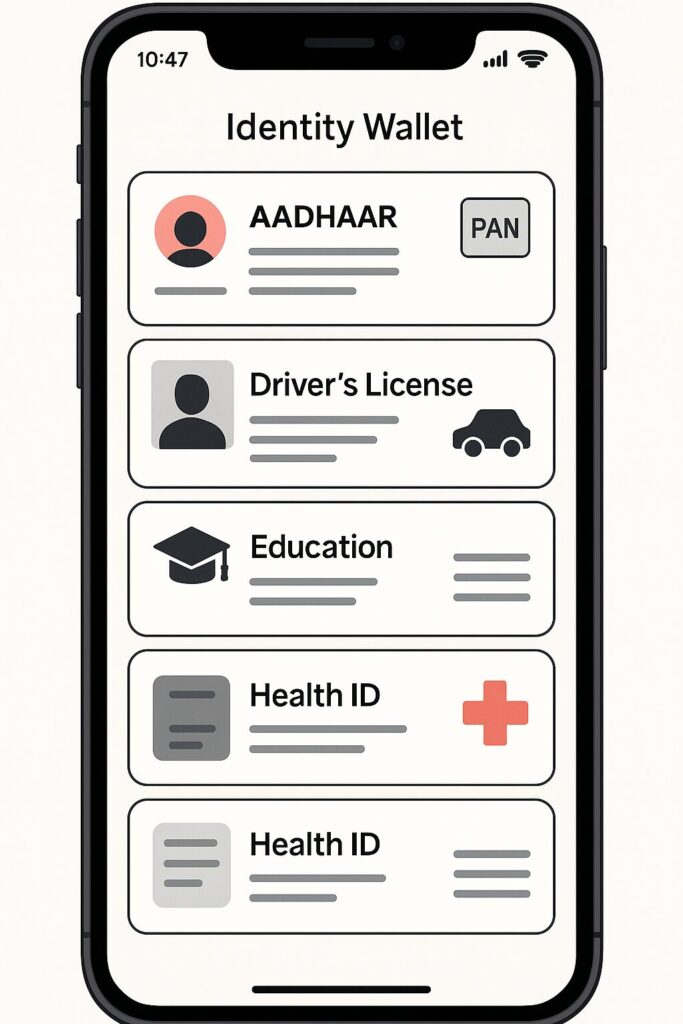

3.3. Self-Sovereign Identity (SSI) Wallet

Identity wallets allow users to:

- Store credentials

- Control what to share

- Authorise access

- Enable selective disclosure

Think of it as DigiLocker 2.0, but with blockchain-verified credentials and full user control.

Together, DIDs + VCs + SSI create a trust-minimised identity ecosystem built on blockchain.

4. Blockchain Identity Architecture for India: A Proposed Model

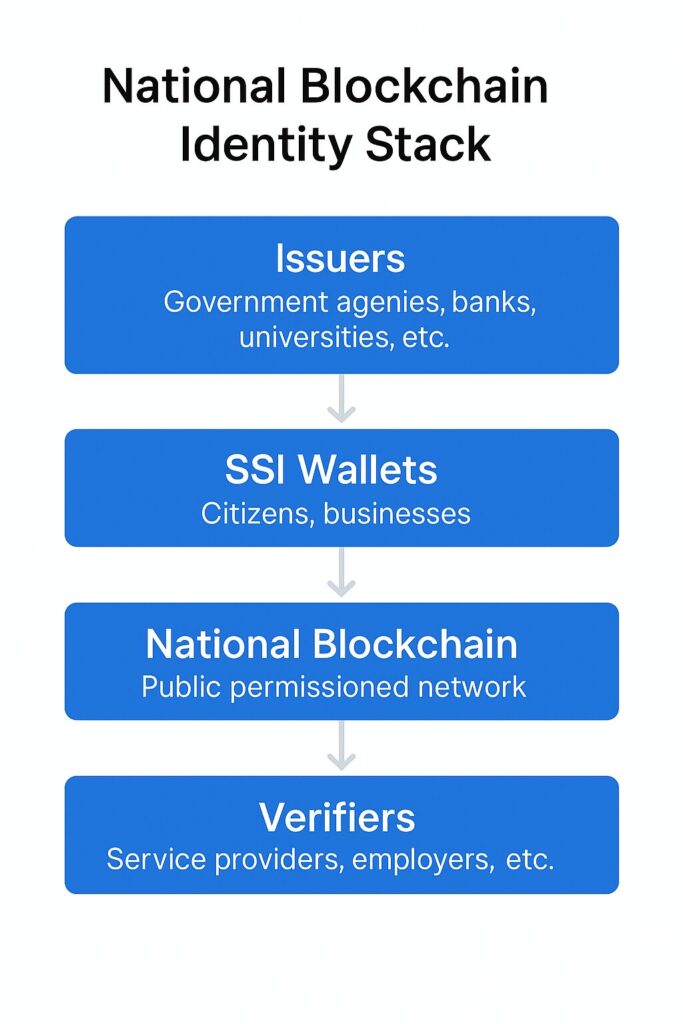

Below is a conceptual architecture that India could adopt for a large-scale, national decentralised identity system.

Your Attractive Heading

4.1. Public Permissioned Blockchain as the Trust Layer

India could adopt a public permissioned blockchain such as:

- IndiaChain 2.0 (proposed)

- a Bharat Web3 stack

- a network overseen by MeitY/NPCI/NHA

All identity issuers (government, universities, banks, regulators, etc.) become trusted nodes.

Only DIDs and cryptographic proofs go on the blockchain—no personal data.

4.2. Identity Issuers

These include:

- UIDAI

- Ministries and state departments

- RBI-regulated entities

- Schools and universities

- Hospitals and healthcare providers

- Municipal corporations

- GST network

- NPCI

- Banks, insurance companies

- Large corporates (employment credentials)

Each issuer signs credentials digitally and anchors proofs on blockchain.

4.3. Identity Holders (Citizens and Businesses)

They hold their credentials in:

- Phone-based SSI wallets

- DigiLocker (upgraded to support DIDs/VCs)

- Enterprise identity wallets

- Cloud wallets for those who need them

Citizens retain ownership of credentials.

4.4. Identity Verifiers

Any service provider can verify a credential by simply checking:

- Digital signature

- Blockchain anchor

- Revocation status

Verification does not require contacting the issuer, reducing costs and server load.

4.5. Zero-Knowledge Proof Layer

This enables privacy-preserving verification:

- Prove over 18 without sharing birthdate

- Verify income category without revealing salary

- Validate qualifications without sharing grade sheets

- Demonstrate tax compliance without exposing entire ITR

This represents a major privacy upgrade over Aadhaar.

5. Use Cases Across Sectors: How Blockchain Identity Transforms India

5.1. Governance and Public Services

- Birth and death certificates

- Land titles (solving India’s biggest property fraud problem)

- Caste certificates

- Pension authentication

- Ration distribution

- Scholarship eligibility

- Smart city services

Blockchain eliminates document forgery and reduces bureaucratic delays.

5.2. Financial Services & KYC

Blockchain can enable Reusable KYC with dramatic impact:

- Banks can access KYC credentials instantly

- No repeated uploads, scans, or visits

- Fraudulent identities are spotted early

- Telecom KYC becomes near-zero cost

- NBFCs, fintechs, and insurance improve onboarding

- Cross-border financial interactions become smoother

Global models like European eIDAS 2.0, Singapore’s SingPass, and UAE’s digital identity provide reference points.

5.3. Healthcare

Blockchain identity enables:

- Portability of health records

- Fraud-free insurance claims

- Authentication of doctors, nurses, health workers

- Credential verification for medical colleges

- e-prescriptions and telemedicine

- National Health Stack integration

Patients retain control over who accesses their data.

5.4. Education and Workforce

Digital identity can transform India’s massive education-employment ecosystem:

- Authentic degrees & diplomas

- Skill certificates (NSDC, ITI, polytechnic)

- Work history & employer references

- Skill-based matching for jobs

- Fraud-free hiring

- Verifiable experience records for gig workers, cab drivers, delivery partners, construction labour

The fake degree/fake certificate industry becomes nearly impossible.

5.5. MSME and Business Identity

India has 90+ million MSMEs, many lacking formal identity.

Blockchain enables:

- Verifiable GST details

- Digital business passports

- Supply-chain trust

- Cross-border trade

- Instant credit assessment

- ONDC-compatible digital commerce

This unlocks credit growth and reduces compliance friction.

5.6. Logistics & Supply Chain

Each asset can have a DID:

- Container identity

- Warehouse identity

- Truck identity

- Spare part identity

- Cold-chain cargo identity

This prevents:

- Cargo tampering

- Counterfeit goods

- Tax leakage

- Misrouting

Blockchain identity strengthens ONDC, ULIP, and logistics digitisation.

5.7. IoT, Smart Cities, and Industry 4.0

Machines require identity too:

- EV chargers

- Streetlights

- Water meters

- Parking sensors

- CCTV cameras

- Industrial robots

- Drones

Blockchain ensures authentication, security, and audit trails.

6. Global Benchmarks: What India Can Learn

6.1. European Union: eIDAS 2.0

Europe’s “wallet-based identity” is the most advanced global model of:

- SSI

- Verifiable credentials

- Privacy-by-design architecture

India can adopt similar principles.

6.2. Estonia

The world’s first digital republic uses blockchain for:

- Citizen identity

- Healthcare

- Tax services

- Public records

Estonia’s KSI blockchain inspires a possible India model.

6.3. Singapore

SingPass integrates:

- Digital identity

- KYC

- Government services

- Private-sector interactions

India’s DPI could integrate similar cross-sector capabilities.

6.4. UAE & Saudi Arabia

They use blockchain identity for:

- Immigration

- Banking

- Employment visas

- Cross-border financial flows

India can apply these lessons to international worker migration.

6.5. Canada and Australia

Both countries are building federal digital identities based on:

- Privacy

- Consent

- Distributed verification

India’s federal structure can benefit from these approaches.

7. Benefits for India: Economic, Social, and Governance Impact

7.1. Economic Benefits

- Reduce KYC cost: ₹25,000–40,000 crore savings over 10 years

- Prevent financial fraud: ₹18,000 crore annual savings

- Enable MSME credit access: +₹5–7 lakh crore credit expansion

- Boost cross-border trade: +0.5–1% GDP impact

- Reduce identity-related scams: elimination of fake IDs, certificates

7.2. Social Benefits

- Empower rural citizens with portable credentials

- Reduce dependency on intermediaries

- Improve trust in government systems

- Expand access to social welfare

7.3. Governance Benefits

- Better targeting of subsidies

- Instant eligibility checks

- Fraud-free land records

- Improved disaster management

- Strengthened national security

A blockchain-based identity ecosystem aligns perfectly with India’s ambitions for:

- Smart cities

- Digital commerce

- Public health

- Green mobility

- Industry 4.0

- Global competitiveness

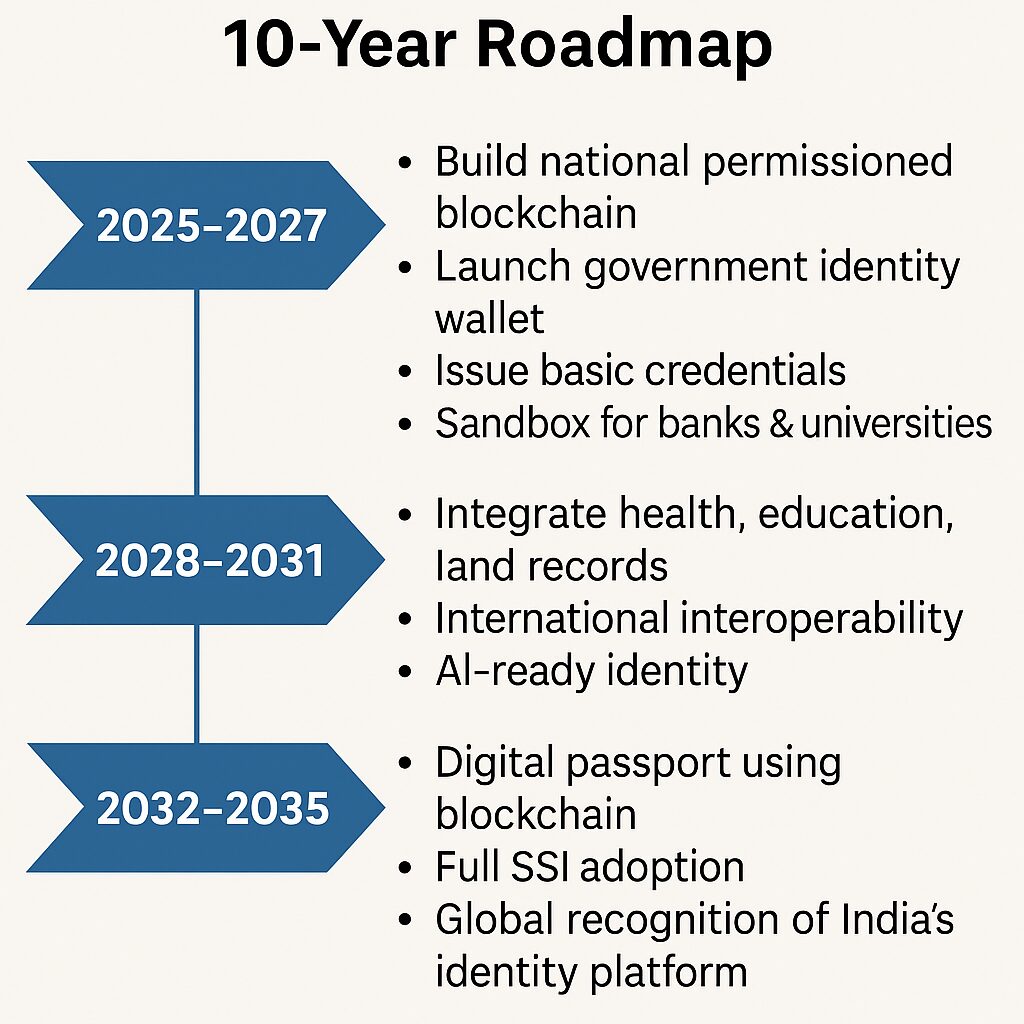

8. Implementation Roadmap for India (2025–2035)

Phase 1: Foundation (2025–2027)

- Create national blockchain identity standards

- Introduce DIDs in DigiLocker

- Pilot verifiable credentials for universities, driving licences

- Create public permissioned blockchain network

Estimated investment: ₹8,000–10,000 crore

Phase 2: Expansion (2027–2030)

- Expand to banking, telecom, healthcare

- Introduce Reusable KYC and portable skill credentials

- Integrate with Health Stack and UPI

- Identity for MSMEs and supply chain actors

Estimated investment: ₹12,000–15,000 crore

Phase 3: Global & Cross-Sector Integration (2030–2035)

- Global interoperability (travel, migration, education)

- Machine identity for IoT & EV ecosystems

- Full SSI adoption across all government platforms

- India becomes a world leader in decentralised identity exports

Estimated investment: ₹15,000–20,000 crore

Total projected 10-year investment: ₹35,000–45,000 crore, with returns many times higher.

9. Challenges India Must Address

9.1. Legal and Regulatory Framework

Need for:

- Digital Identity Act

- Blockchain Governance Framework

- Data Protection compliance

- Digital signature standards for VCs

9.2. Privacy vs. Surveillance Concerns

SSI solves many issues, but India must ensure:

- No central tracking

- No unnecessary metadata exposure

- Strong revocation systems

9.3. Digital Divide

Offline/low-tech identity wallets must be designed.

9.4. Governance of Blockchain Infrastructure

Need clear definitions of:

- Node operators

- Consensus models

- Audit structures

- Liability frameworks

9.5. Adoption Resistance

Govt officers, banks, universities may resist change.

9.6. Interoperability

India must follow W3C DID and VC standards.

10. The Future: What Blockchain-Based Identity Means for India

A blockchain-based digital identity ecosystem unlocks a powerful vision for India:

- Citizens control their data

- Fraud becomes expensive

- Public services become frictionless

- MSMEs become globally trusted

- Students and workers gain global mobility

- Cross-border digital commerce flourishes

- India becomes a champion of trusted digital public goods

This aligns perfectly with India’s digital future:

- Digital Public Infrastructure (DPI)

- Web3 adoption

- Smart manufacturing

- Decentralised commerce

- Global leadership in technology

In the next decade, identity will not be just a number or a card—it will be:

- Portable

- Private

- Verifiable anywhere

- Citizen-controlled

- Blockchain-anchored

- Interoperable across apps and countries

- Trusted by machines as much as humans

India has already built the foundation with Aadhaar, UPI, DigiLocker, CoWIN, and ONDC.

The next chapter is Digital Identity 2.0—powered by blockchain.

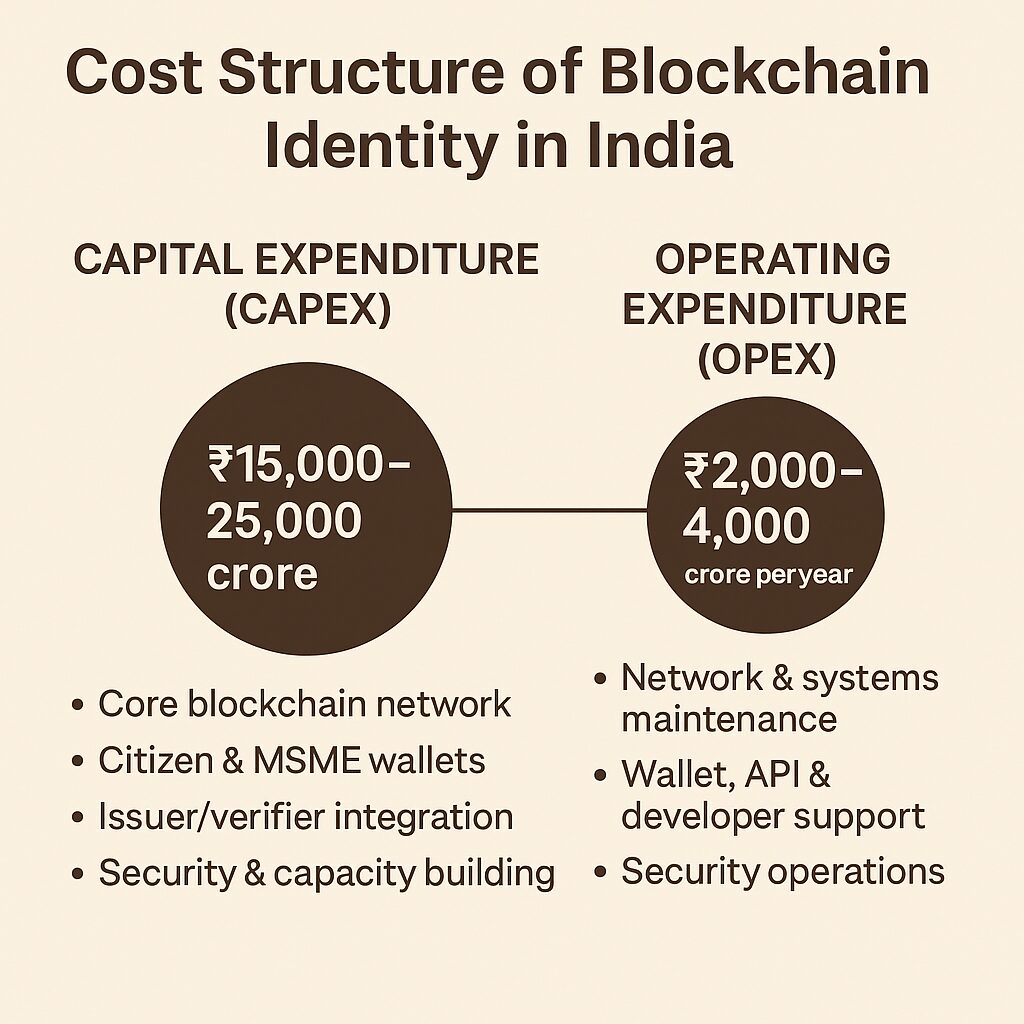

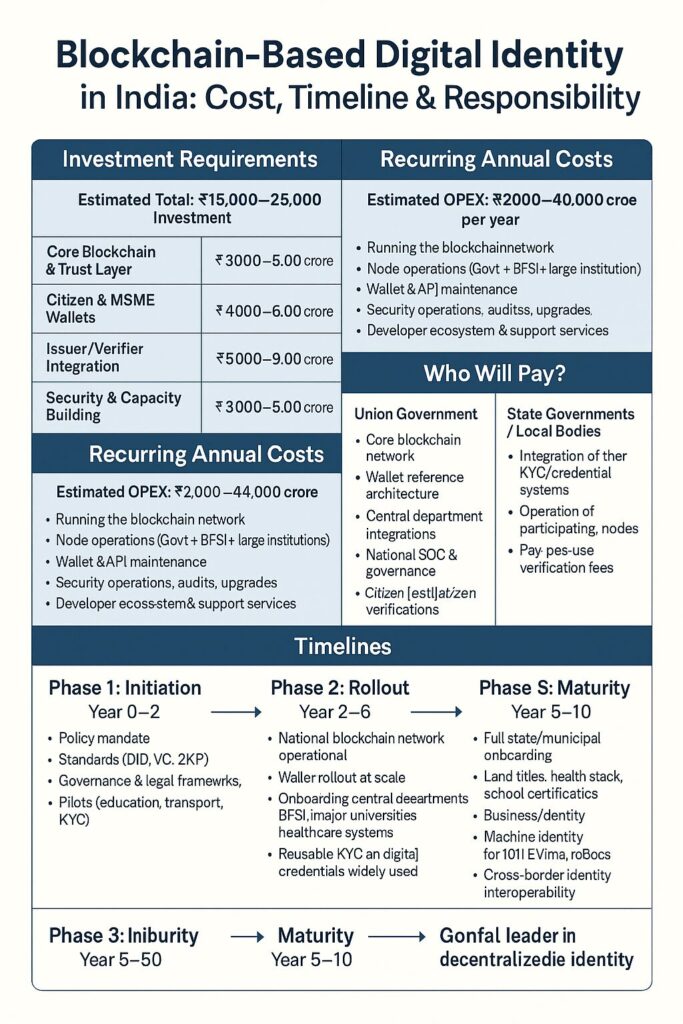

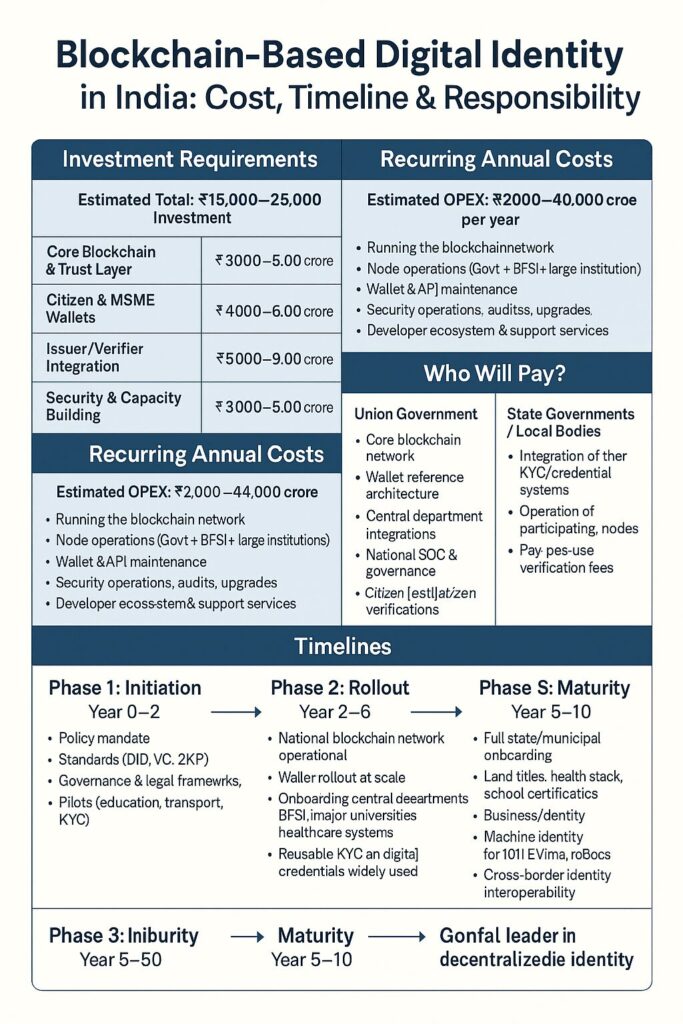

11. Investment Required – One-Time, Recurring, and Who Pays

There is no official Indian cost estimate yet for a nationwide blockchain-based identity stack. So what follows is a reasoned, order-of-magnitude planning envelope, anchored in:

- Known Aadhaar budgets (₹8,962 crore approved up to 2017 for Phases I–III, plus ₹3,436 crore for Phase IV) UIDAI+1

- Experience from operating DPI platforms like DigiLocker with tens of crores of users Press Information Bureau+1

- Global costing frameworks and fee models from the World Bank’s ID4D programme id4d.worldbank.org+3id4d.worldbank.org+3id4d.worldbank.org+3

- International moves such as eIDAS 2.0 / EU Digital Identity Wallet and Estonia’s X-Road. Invest in Estonia+3European Commission+3jumio.com+3

11.1 One-Time / Capital Investment (10-year horizon)

Think of India’s blockchain-based identity as:

- A national trust layer (permissioned blockchain network)

- Wallets for citizens & businesses

- Issuer integration across sectors

- Security, governance, and operations

A reasonable 10-year, all-India CAPEX envelope (central + state + private sector) could be in the ballpark of:

₹15,000–25,000 crore (rough, scenario-based estimate)

- Core blockchain + trust infrastructure – ₹3,000–5,000 crore

- Design & build of the public-permissioned network

- Data centres / cloud, HSMs, consensus infrastructure

- National key management and network monitoring

- Integration with existing DPI (Aadhaar, DigiLocker, UPI, CoWIN, etc.)

- Wallet & application layer – ₹4,000–6,000 crore

- Citizen SSI wallets (mobile + web + assisted modes)

- Business & MSME identity wallets

- Integrations with DigiLocker, India Stack APIs, ONDC, NPCI rails

- Accessibility features (multi-language, offline, low-end phone support)

- Issuer and verifier integration – ₹5,000–9,000 crore

- Government departments (central + states)

- BFSI sector (banks, NBFCs, insurance, securities)

- Healthcare, education, municipal bodies, regulators

- Supply chain, logistics, MSME, ONDC participants

- Migration of existing databases to verifiable credentials model

- Security, capacity building, change management – ₹3,000–5,000 crore

- National SOC, continuous audits, red teaming

- Training for officials, banks, universities, hospitals

- Awareness campaigns, grievance redressal systems

From an economic perspective, this is comparable to or somewhat above the total approved spends in early Aadhaar phases, but spread over more sectors and using more advanced cryptography and blockchain infrastructure. UIDAI+2Press Information Bureau+2

Our Current Estimate:

“Based on India’s past spending on Aadhaar and DPI, and global costing frameworks from the World Bank’s ID4D, a full-scale blockchain-based identity stack for India could require roughly ₹15,000–25,000 crore in one-time investments over a 10-year period, shared across government and regulated industries.”

11.2 Recurring / Operating Costs

Ongoing costs fall under:

- Running the blockchain and trust services

- Operating nodes at government and large institutional participants

- Maintaining wallets, APIs, SDKs, and developer ecosystems

- Security operations (SOC, monitoring, incident response)

- Continuous upgrades and compliance

Based on large ID systems and ID4D’s analysis of operational cost drivers such as infrastructure, personnel and per-authentication costs id4d.worldbank.org+2World Bank+2, a reasonable annual OPEX envelope for India at steady state could be around:

₹2,000–4,000 crore per year, once the system is fully rolled out.

This would likely be recovered partly via:

- Modest API / verification fees for high-volume private sector users (banks, telecom, fintech, insurers etc.), similar to how many countries structure ID verification pricing. id4d.worldbank.org+1

- General budgetary support for core public-good functions (subsidised or free verification for government welfare schemes, healthcare, education, etc.).

- Efficiency savings from reduced fraud, ghost beneficiaries and duplicate KYC, which many studies show can be substantial for digital ID systems. id4d.worldbank.org+1

11.3 Who Pays for What?

1. Union Government (MeitY, UIDAI, NHA, NPCI-like entities)

Likely to fund:

- Core blockchain / DPI infrastructure

- Common wallets and reference implementations

- Integration of central schemes & regulators

- National security and governance mechanisms

- Subsidised access for social schemes and the poorest citizens

2. State Governments & Local Bodies

- Integration of state schemes, municipal services, land records, health & education departments

- State-level outreach, training, and citizen assistance centres

3. Regulated Private Sector (BFSI, telecom, healthcare, education)

- Integration of their own KYC / onboarding / credential systems

- Operation of their nodes (if they participate directly in the network)

- Internal process re-engineering, compliance, and security upgrades

4. Large Enterprises, MSMEs, Start-ups

- Building and maintaining sector-specific credentials (e.g., employment records, skill certifications)

- Pay-per-use or subscription fees for verification APIs

- Developing new business models on top of the identity stack (Web3 / SSI startups, verifiers, aggregators, analytics etc.)

Summary:

“Capital expenditure on the core blockchain identity stack will be primarily public, while recurring costs and sector-specific integration will be shared between government and regulated industries, with part of the cost recovered through low per-transaction fees and productivity gains.”

12. Time Required – From Initiation to Completion

Again, there is no official GoI timeline yet for a full-blown, blockchain-based national identity stack. But drawing on:

- MeitY’s National Strategy on Blockchain with short-term and long-term milestones Press Information Bureau+1

- EU’s timeline under eIDAS 2.0 (member states must roll out EU Digital Identity Wallets by around 2026) jumio.com+1

- Experience of countries like Estonia that took a decade-plus to fully mature their e-governance stack e-Estonia+1

you can frame a realistic 3-phase Indian timeline like this:

12.1 Initiation Phase (≈ 12–24 months after political “green signal”)

Activities:

- Policy decision and mandate (Cabinet / Parliament route, if needed)

- Formation of a National Digital Identity 2.0 Task Force

- Finalisation of:

- Architecture and standards (DIDs, VCs, ZKPs, consent frameworks)

- Governance model for the blockchain network

- Legal framework adjustments (IT Act rules, Digital Personal Data Protection alignment, etc.)

- Prototyping and limited pilots:

- A few central schemes

- Select universities / regulators

- One or two financial sector KYC pilots

Indicative duration: ~1–2 years from formal “go” to meaningful pilots going live.

12.2 Expansion / Rollout Phase (≈ Years 2–5)

Activities:

- Scaling the blockchain network nationally

- Onboarding of:

- Central ministries, NHA, GSTN, NPCI, passport, transport

- Major banks, insurance, telecom operators

- Large universities, professional bodies, health systems

- Rolling out citizen and MSME wallets (mobile + DigiLocker integration)

- Starting cross-border pilots (e.g., with friendly countries / regional blocs)

By Year 5, a large proportion of urban and digitally active citizens could be using blockchain-based credentials for KYC, education, and select government services.

12.3 Maturity & Deep Integration (≈ Years 5–10)

Activities:

- Gradual onboarding of:

- All states and districts

- Municipalities and panchayats

- Smaller institutions (schools, small hospitals, cooperative banks, etc.)

- Widespread machine identity for IoT, EV infra, smart-city services

- International interoperability (education, migration, financial services)

- Continuous privacy and security enhancements

By Year 8–10, India can reasonably reach a mature, widely used, blockchain-based identity ecosystem, interoperable with Aadhaar and other DPI layers.

Our Assessment:

- Initiation:

“Once a clear policy decision is taken, India would need about 12–24 months to finalise standards, governance structures, and initial pilots for a blockchain-based identity stack.” - Substantial completion:

“A realistic timeframe for a national-scale, multi-sector rollout is 7–10 years from initiation, with meaningful benefits visible by Year 3–5 and deep integration across sectors by Year 8–10.”

————————————————————————————————————

13. Conclusion: A New Identity Paradigm for a Billion Indians

Blockchain-based Aadhaar was the first revolutionary leap.

identity will be the second.

Where Aadhaar brought recognition, blockchain will bring empowerment.

Where Aadhaar brought scale, blockchain will bring control and privacy.

Where Aadhaar brought inclusion, blockchain will bring global interoperability.

India stands at the cusp of creating one of the world’s most advanced digital identity ecosystems—secure, decentralised, citizen-centric, and future-proof.

The question is no longer whether India should adopt blockchain-based identity, but how quickly it can implement it to unlock the next trillion-dollar digital opportunity.

———————————————————————————————————

14 Suggested References (for concepts, technology & Indian context and further reading)

- UIDAI & Aadhaar Costs / Scale

- Government of India, Rajya Sabha reply on Aadhaar project cost approvals for Phases I–III – approx. ₹8,962 crore approved up to March 2017. UIDAI

- Press release on Phase IV cost estimates of the UID scheme (₹3,436 crore). Press Information Bureau

- Various estimates of full life-cycle cost of Aadhaar (₹44,000–70,000 crore) discussed in secondary analyses. Medium

- DigiLocker & DPI in India

- Press Information Bureau note on Digital India platforms, including DigiLocker scale (53.92 crore users as of June 2025). Press Information Bureau+1

- Budget 2023 coverage on “Entity DigiLocker” and usage statistics. The Economic Times

- Blockchain Strategy & DPI

- MeitY, National Strategy on Blockchain (strategic roadmap for blockchain adoption in India). Press Information Bureau

- NITI Aayog, Blockchain: The India Strategy – Part I (overview of blockchain, public permissioned models, and government use cases). NITI AAYOG

- Government/IES paper on Digital Public Infrastructure in India and UK (DPI building blocks, including ID, payments, data). IES

- Global Digital Identity & Costing

- World Bank, Identification for Development (ID4D) – conceptual frameworks & cost–benefit evaluation for ID systems. id4d.worldbank.org+2id4d.worldbank.org+2

- World Bank, Identity Authentication and Verification Fees – Overview of Current Practices (per-authentication pricing models). World Bank+1

- McKinsey Global Institute, Digital India: Technology to Transform a Connected Nation – impact of Aadhaar and DPI on India’s digital economy. McKinsey & Company

- Standards for Blockchain-Based Identity

- W3C, Decentralized Identifiers (DIDs) v1.0 – official web standard defining DIDs. w3.org+1

- W3C, Verifiable Credentials Data Model v1.1 and v2.0 – core data model for verifiable credentials. w3c.github.io+3w3.org+3w3.org+3

- Global Case Studies

- Estonia’s X-Road and KSI blockchain as backbone of e-governance. e-Estonia+1

- EU eIDAS 2.0 & EU Digital Identity Wallet initiative. European Commission+1

ONE-PAGE SUMMARY BOX

Cost – Time – Responsibility Matrix for India’s Blockchain-Based Digital Identity System

1. Investment Requirements

One-Time / Capital Investment (10-Year Horizon)

Estimated Total: ₹15,000 – ₹25,000 crore

| Component | Estimated Cost | What It Covers |

| Core Blockchain & Trust Layer | ₹3,000–5,000 crore | Permissioned blockchain network; HSMs; consensus infra; DPI integration |

| Citizen & MSME Wallets | ₹4,000–6,000 crore | SSI mobile/web wallets; DigiLocker integration; offline/low-end device support |

| Issuer/Verifier Integration | ₹5,000–9,000 crore | Banks, NBFCs, insurers, state departments, universities, hospitals, regulators |

| Security & Capacity Building | ₹3,000–5,000 crore | SOC, audits, training for officials, outreach, grievance systems |

2. Recurring / Annual Costs

Estimated OPEX: ₹2,000 – ₹4,000 crore per year

Covers:

- Running the blockchain network

- Node operations (Govt + BFSI + large institutions)

- Wallet & API maintenance

- Security operations, audits, upgrades

- Developer ecosystem & support services

Partially recoverable through low-cost verification APIs, especially for BFSI, telecom, insurance, logistics, ONDC, edu-tech and health-tech ecosystems.

3. Who Will Pay?

Union Government

- Core blockchain network

- Wallet reference architecture

- Central department integrations

- National SOC & governance

- Subsidised citizen verifications (welfare, health, education)

State Governments / Local Bodies

- State schemes, land records, municipal services

- Integration of schools, hospitals, police, transport

- Citizen facilitation centres

Regulated Private Sector (Banks, Telecom, Insurance, Healthcare)

- Integration of their own KYC/credential systems

- Operation of participating nodes

- Pay-per-use verification fees

Enterprises, MSMEs, Start-ups

- Wallet adoption

- Integration into ONDC, supply chain, HR systems

- Sector-specific VC issuance

- Using APIs for verification

4. Timelines

Phase 1: Initiation (Year 0–2)

- Policy mandate

- Standards (DID, VC, ZKP)

- Governance & legal frameworks

- Pilots (education, transport, KYC)

Phase 2: Rollout (Year 2–5)

- National blockchain network operational

- Wallet rollout at scale

- Onboarding central departments, BFSI, major universities, healthcare systems

- Reusable KYC and digital credentials widely used

Phase 3: Maturity (Year 5–10)

- Full state/municipal onboarding

- Land titles, health stack, school certificates, business identity

- Machine identity for IoT, EV infra, robotics

- Cross-border identity interoperability

- India becomes global leader in decentralised identity systems

In One Line:

India can build a world-leading blockchain-based digital identity system with a 10-year investment of ₹15,000–25,000 crore, annual operating cost of ₹2,000–4,000 crore, and phased rollout over 7–10 years, jointly funded by central government, states, and regulated private-sector institutions.

PHASE–TIME–INVESTMENT–RESPONSIBILITY TABLE

Perfect for inserting as a table within the article

Table: Blockchain Identity Implementation Roadmap for India (2025–2035)

| Phase | Timeline | Major Activities | Estimated Investment | Lead Stakeholders |

| Phase 1: Initiation & Pilot | Year 0–2 | Policy approval; architecture & standards (DID/VC/ZKP); legal updates; blockchain test net; pilots in KYC, education, driving licences | ₹2,500–4,000 crore | MeitY, UIDAI, NITI Aayog, NPCI-like body, selected banks, universities, state IT departments |

| Phase 2: National Rollout | Year 2–5 | National permissioned blockchain network; SSI wallet rollout; integration of central ministries, GSTN, NHA, BFSI; Reusable KYC live; DigiLocker 2.0 | ₹7,000–10,000 crore | Union Government, RBI-regulated institutions (banks, NBFCs, insurance), large hospitals, UGC/AICTE bodies, state departments |

| Phase 3: Full Sector Integration | Year 5–8 | Integration of all state govts; land records, municipal services; education & skill credentials; health stack interoperability; MSME identity | ₹3,000–6,000 crore | State governments, municipal bodies, health systems, school boards, MSME Ministry, private verifiers |

| Phase 4: Maturity & Global Interoperability | Year 8–10 | Machine identity (IoT, EV infra, robotics), cross-border credentials (travel, migration, education), privacy tech upgrades, international agreements | ₹2,000–5,000 crore | MEA, DGCA/Transport authorities, private digital ecosystem, global partners (EU, Singapore, UAE, etc.) |